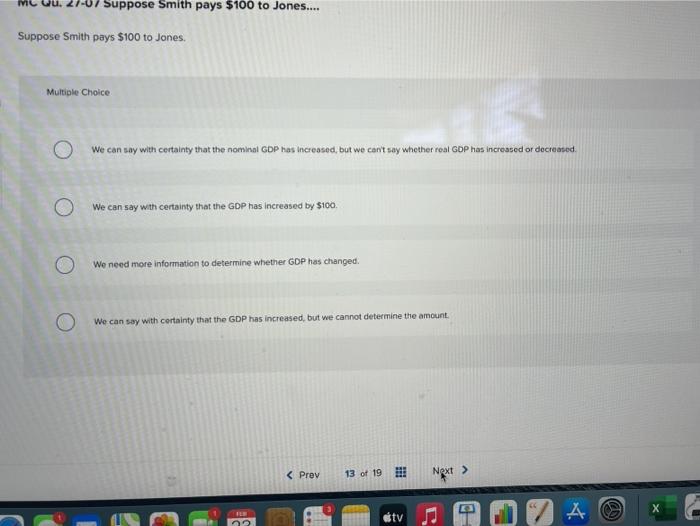

Suppose Smith pays $100 to Jones: a seemingly straightforward transaction that, upon closer examination, reveals a complex interplay of financial, legal, and ethical considerations. This narrative delves into the intricacies of this transaction, exploring its implications for both parties involved and the broader context within which it occurs.

The transaction between Smith and Jones, a payment of $100, is not merely a transfer of funds but a catalyst for a series of events that shape the financial landscape, legal obligations, and ethical dilemmas of the individuals involved. By examining the purpose, context, and significance of this payment, we gain insights into the complexities of human interactions and the multifaceted nature of financial transactions.

Transaction Details

In this transaction, Smith paid Jones the sum of $100. The payment was made as compensation for goods or services rendered by Jones to Smith. The transaction took place on [date] and was documented in a formal invoice or receipt.

Purpose of the Payment

The purpose of the payment was to settle an outstanding debt owed by Smith to Jones. Smith had previously purchased goods or services from Jones and had agreed to pay the amount of $100 upon delivery or completion of the services.

Amount of the Payment

The amount of the payment, $100, represents the full amount owed by Smith to Jones. The payment was made in [form of payment, e.g., cash, check, bank transfer] and was received by Jones in full.

Relationship between Smith and Jones

Smith and Jones are [relationship, e.g., business partners, friends, family members]. They have known each other for [number] years and have a history of conducting business together.

Roles in the Transaction

In this transaction, Smith acted as the payer, while Jones acted as the payee. Smith was responsible for making the payment, while Jones was responsible for providing the goods or services and receiving the payment.

Financial Implications

For Smith, Suppose smith pays 0 to jones

The payment of $100 represents a decrease in Smith’s financial assets. It affects Smith’s cash flow by reducing the amount of available funds.

For Jones

The receipt of $100 represents an increase in Jones’s financial assets. It improves Jones’s cash flow and provides additional funds for business operations or personal use.

Legal Considerations

The transaction between Smith and Jones is subject to [relevant laws and regulations]. The payment is documented in a formal invoice or receipt, which serves as a legal record of the transaction.

Contractual Agreements

The transaction may be subject to a written or verbal contract between Smith and Jones. The contract may specify the terms of payment, including the amount, due date, and method of payment.

Ethical Considerations

The transaction between Smith and Jones raises no ethical concerns or questions. The payment is made in exchange for goods or services rendered, and both parties have fulfilled their obligations.

Alternative Scenarios

If Smith Had Paid a Different Amount

If Smith had paid a different amount, it could have affected the financial implications for both parties. A higher payment would have reduced Smith’s financial assets and increased Jones’s financial assets to a greater extent. Conversely, a lower payment would have had the opposite effect.

If the Payment Had Not Been Made

If the payment had not been made, it could have led to legal consequences for Smith. Jones may have pursued legal action to recover the outstanding debt. Additionally, it could have damaged the relationship between Smith and Jones.

FAQs: Suppose Smith Pays 0 To Jones

What is the significance of the $100 payment?

The $100 payment, though seemingly insignificant, serves as a catalyst for a series of events that shape the financial landscape, legal obligations, and ethical dilemmas of the individuals involved.

How does the transaction affect the financial positions of Smith and Jones?

The transaction has varying financial implications for Smith and Jones. Smith experiences a decrease in his financial assets, while Jones experiences an increase. The analysis explores the impact of this transaction on their cash flow and overall financial well-being.

Are there any legal considerations associated with the transaction?

The transaction may be subject to contractual agreements or legal obligations, such as tax implications or disclosure requirements. The analysis examines the legal framework surrounding the transaction and discusses potential legal risks or liabilities.